What is the Essence of the Consumption Tax?

Consumption tax is a levy imposed upon the purchase of goods or receipt of services. It stands as a familiar tax for many, as it is one uniformly borne by every individual consuming it. Consequently, fluctuations in the tax rate wield a broad impact.

Products typically traverse through the hands of producers, distributors, and retailers before reaching the consumer. The intergenerational chain of intermediary transactions incurs the imposition of consumption tax. This tax is collected at the intermediate transaction stage, aiming to prevent the cumulation of tax burdens, be it double or triple.

1. The Genesis of Japan's Consumption Tax

On April 1, 1989, Japan inaugurated its first-ever consumption tax.

Approximately three decades have elapsed since the introduction of the consumption tax in Japan. For today's Japanese youth, aged in their teens and twenties, the consumption tax has been a constant presence throughout their recollections. Nowadays, the consumption tax is regarded as a matter of course by the Japanese populace. However, are you aware that when the consumption tax was initially introduced 30 years ago, it stirred significant controversy in Japan?

The consumption tax, a novel levy targeting the commonplace "consumption" activities of the general public, elicited massive negative reactions that directly impacted the daily lives of the citizens. Opposition movements sprang up across the nation. At that time, there was considerable public interest in the consumption tax, with television and newspaper news reporting on it almost daily.

Japan was then swiftly transitioning into an aging society at an unprecedented pace worldwide. A diminishing public income resulted in a rapid increase in medical and social security costs, instigating a profound societal crisis. Against this backdrop, and to secure financial resources for healthcare and welfare, the decision was made to levy the consumption tax.

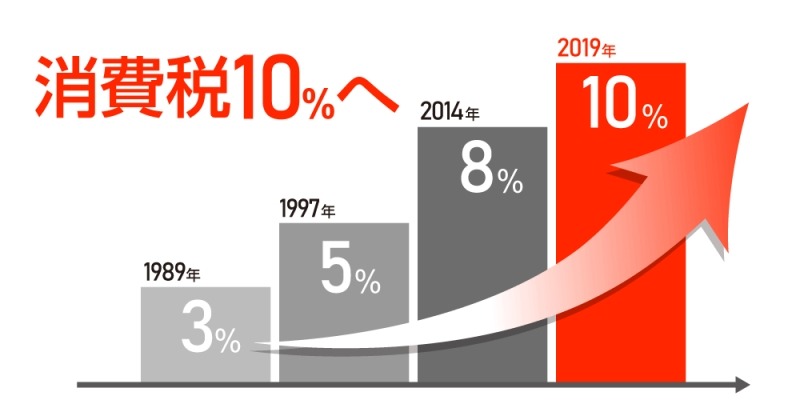

Subsequently, over time, the consumption tax escalated, reaching 5% in April 1997, rising to 8% in April 2014, and further elevating to 10% in October 2019 (with reduced rates of 8% for food and beverages and newspapers).

2. What is the consumption tax rate in various countries worldwide?

Japan initiated the imposition of consumption tax in 1989, while Europe has adopted the Value Added Tax (VAT), a system similar to consumption tax.

As of January 2023, data indicates that the global average VAT rate (consumption tax rate) stands at 17.6%.

Hungary boasts the highest consumption tax at 27%, followed by Croatia, Denmark, Norway, and Sweden, all at 25%. European countries lead the world in consumption tax rates, with Asian countries often having rates below the global average, including Japan, where the rate is 10%.

3. The Evolution of Consumption Tax Rates in Japan

| Tax Rate | |

|---|---|

| April 1, 1989 (Heisei 1) | 3% |

| April 1, 1997 | 5% (National 4% + Local 1%) |

| April 1, 2014 | 8% (National 6.3% + Local 1.7%) |

| October 1, 2019 | Standard Rate 10% (National 7.8% + Local 2.2%) Reduced Rate 8% (National 6.24% + Local 1.76%) |

4. What is Japan's reduced tax rate system?

The reduced tax rate system in Japan entails a lower consumption tax for specific goods and products compared to the standard tax rate.

Introduced on October 1, 2019, when the consumption tax rate increased to 10%, certain products maintained a tax rate of 8%.

The Japanese government implemented this reduced tax rate system with the aim of alleviating the burden of daily life. Recognizing that consumption tax is borne equally by all individuals, the system seeks to prevent an excessive burden on low-income groups.

Which products qualify for the reduced tax rate?

Beverages and food (excluding alcoholic beverages and alcoholic beverages consumed outside the home) and newspapers published twice a week or more with a subscription contract are eligible for the reduced tax rate.

[8% Consumption Tax Examples]

| Non-alcoholic beer | Beverages with an alcohol content of less than 1% are classified as beverages. |

|---|---|

| Sake cooked with mirin seasoning Do not drink | Classified as a food as a condiment |

| Delivery or take-out | Don't consider eating out |

| Lunch at a paid nursing home | Don't consider eating out |

[10% Consumption Tax Examples]

| Alcoholic beverages | Alcohol content of 1% or more is 10% |

|---|---|

| Sake that has not been mirin treated | Indistinguishable from alcoholic beverages |

| Eat in | Suitable for eating out |

| Catering | Suitable for providing services |

| Newspapers purchased at stations and convenience stores | Not based on subscription agreement |

5. Tax exemption system for foreign tourists visiting Japan

The "Consumption Tax Exemption System" applies to foreign tourists or Japanese temporary returnees who meet the exemption conditions when purchasing items such as electronics, watches, food, and cosmetics. When leaving the country, you need to present the goods to customs:

- You must take the tax-free purchased items out of Japan.

- Applicable to purchases exceeding 5,000 yen (excluding tax) per day from the same store.

The Japanese government revised the consumption tax exemption system starting April 1, 2020, and individuals eligible for tax exemption include:

- Non-residents with "foreign nationality."

- Individuals with qualifications for "short-term stay," "diplomatic," "official business," and similar statuses.

- Those allowed to enter Japan for a period not exceeding 6 months (excluding diplomatic, official business, and U.S. military personnel).

- Your stay in Japan does not exceed 6 months from the date of entry.

For further details, please visit the "English Version" of the Japanese Consumption Tax Exemption System.