The threshold for the Japanese business management visa is known to be 5 million yen. However, the actual expenses far exceed this amount. Apart from the administrative scrivener's fees, there are various costs such as annual rent, wages, taxes, utilities, and others that the company incurs annually. Moreover, these expenses need to be sustained until obtaining the residency status. Some individuals employ ingenuity and leverage their domestic expertise to attempt to reduce the costs associated with the Japanese management visa. Are these so-called techniques truly effective? What are the potential negative consequences? The following provides a detailed elucidation:

1. Setting a very modest salary for oneself

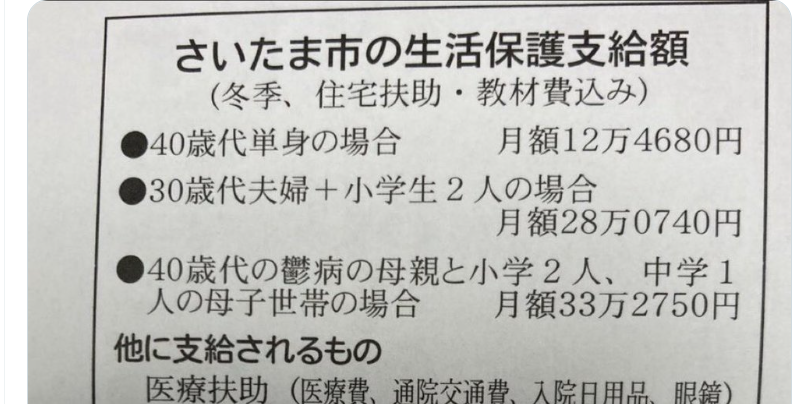

Many individuals, influenced by tax evasion practices in their home country, cunningly opt for a low personal salary in Japan. This action can adversely impact one's social credit, affecting matters such as bank loans, credit card applications, and children's education. Consider the scenario where immigration officials observe that your salary is even lower than the average Japanese income; it becomes apparent that you are attempting to exploit Japanese welfare. Would they readily grant you permanent residency or citizenship?

2. Maintaining a minimal company profit

Similar to the previous point, if a company sustains low profits, its creditworthiness diminishes, making it challenging to secure loans.

3. Diverting income to private accounts

In China, diverting income to private accounts is a widespread practice, often involving underreporting actual earnings. In Japan, this constitutes a severe act of tax evasion. If discovered, it may result in the inability to apply for residency and even imprisonment. Refrain from engaging in such high-risk activities for minor gains.

4. Only contributing to national health insurance, neglecting social insurance and pension

Failing to contribute to social insurance and pension practically precludes the possibility of obtaining permanent residency or citizenship in Japan. Even if you are the spouse of a Japanese national or permanent resident, compliance with these obligations is typically required.

5. Falsely applying for various subsidies

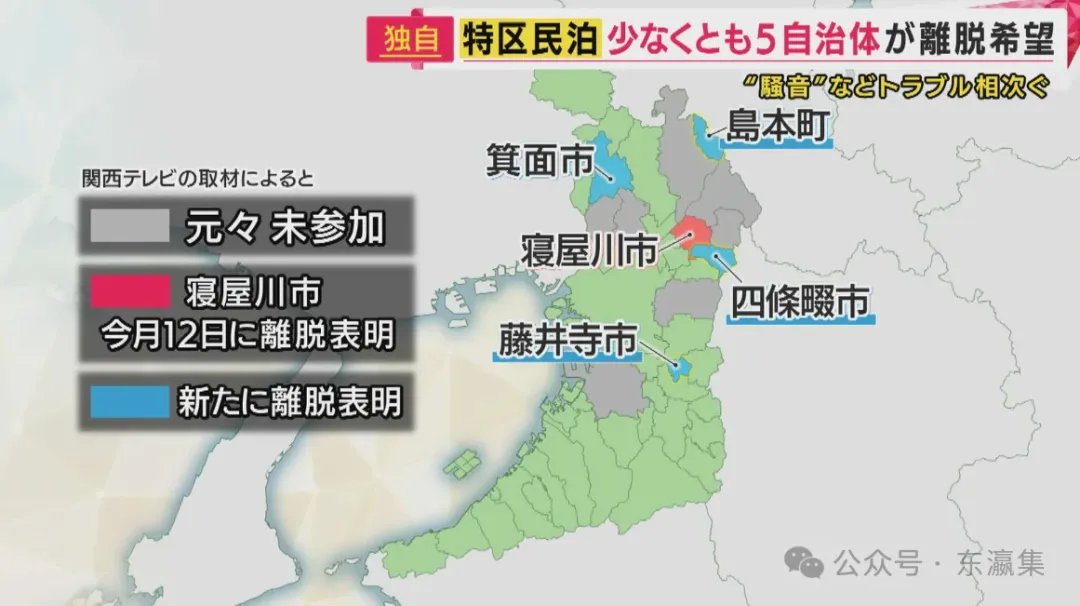

During the pandemic, many Chinese businesses in Japan, driven by the desire for unearned benefits, submitted fraudulent applications for government subsidies.

6. Deceptively obtaining tax refunds with tourist passports

Incidents of using small gifts to deceive Chinese tourists into providing their passports for fraudulent tax refund claims have occurred in Tokyo and Osaka. Chinese enterprises involved in such schemes have faced legal consequences.

7. Including various relatives in one's dependent list

The motivation behind this practice is to increase the number of dependents, thereby reducing taxes and securing additional subsidies. However, this tactic, employed by many Chinese individuals in recent years, has attracted the attention of Japanese immigration authorities.

8. Associating with a work visa without genuine employment

While employer sponsorship is a common immigration method in many Western countries, some individuals have brought this approach to Japan, offering convenience to those unable to secure regular employment in the country. "Employer sponsorship" or "false employment" is a blatant criminal offense in Japan. The core criterion for assessment is whether genuine employment at the specified company exists.

Japan is a country with well-established systems and legal governance. Upon arrival, it is advisable not to attempt to exploit loopholes or engage in clever maneuvers. Facing the consequences of jeopardizing immigration due to a minor infraction or, worse, imprisonment, is a regrettable outcome. Adhering to rules and regulations is the proper path forward.