For wealthy travelers who love Japan, owning a luxury apartment in central Tokyo has become the ultimate "souvenir."

In trendy Daikanyama, a 215 square meter high-rise condo sits waiting for its next owner. With spacious walk-in closets, multiple bedrooms, private balconies, and an open kitchen, this is exactly the kind of property that foreign buyers find irresistible.

Priced at 1.48 billion yen (about 71.5 million RMB), the unit reflects a market where apartments larger than 200 square meters are rare. According to Alex Shapiro, COO and co-founder of Blackship Realty, homes of this size in Tokyo don't stay on the market for long.

"Most of our customers just buy because they love Japan and want a place here," Shapiro said. He has been in the Japanese real estate business for seven years, primarily serving Western buyers.

After years of sluggish growth, Tokyo's luxury condos are now booming thanks to no restrictions on foreign ownership, a weak yen, and Japan's reputation for safety and stability. Demand from foreign buyers has never been greater.

CBRE Japan reports that commercial real estate investment reached 974 billion yen in the second quarter of 2025, with foreign capital playing a larger role. As a result, average condo prices in central Tokyo rose to 131 million yen in the first half of the year – an increase of 20.4% year-on-year.

Shapiro stressed that apartments over 200 square meters are in short supply, which makes them especially valuable.

The Japanese government is concerned that local buyers are being driven out. Authorities have promised to review purchasing patterns, and regulations may be tightened, although for now the market is thriving. Buyers from around the world are purchasing properties through live auctions, private listings, and local experts.

Unlike many Japanese buyers, international customers rarely compromise on space. They prefer multi-bedroom condos in fashionable districts, especially those with views of Mount Fuji or Tokyo Tower, considered priceless.

Shapiro's deals typically range from 500 million to 2 billion yen, mostly in Tokyo. While Osaka and Kyoto are gaining attention, Tokyo still dominates foreign interest.

Kenji Kubo, GM of Plaza Homes, who has been in the industry for over 20 years, remembers when foreign buyers were rare. Now, customers in Hong Kong, Singapore, and Malaysia are eager to secure a second home, avoiding the hassle of hotels during the peak travel season.

“For these customers, owning a property is a status symbol,” Kubo said, noting that most are between 50 and 60.

The motivations of foreign buyers vary. Some have family ties to Japan, others visit frequently for work or leisure, and many see value in a once-quiet market.

Building a Legacy

Chinese investors, in particular, view Japanese real estate as a more stable option than the home market. This trend increased rapidly during the pandemic. In 2023, property firm Kamiumyusan found that 89% of Chinese investors wanted to look for a home in Japan after border restrictions were lifted.

Daisuke Inazawa of Ina & Associates wrote that Japan's appeal lies in its ownership rules. Unlike China, where land use rights are a maximum of 70 years, Japan allows perpetual ownership. For buyers hoping to transfer wealth to the next generation, this is a big attraction.

“For Chinese investors, permanent ownership is not just an investment – it is the foundation of family wealth,” Inazawa explained. Other motivations include stable rental income and solid returns.

Shapiro agreed that Japan's property market is attractive to Chinese buyers, but less so to Westerners, who already enjoy permanent ownership of a home. Rental yields in Tokyo average around 4% for a ¥100 million property, while in Beijing or Shanghai, it is around 2%. In Los Angeles, yields could still reach 7-10%, making Japan less attractive to Americans and Europeans.

Dreams of Homeowners

Foreign demand has certainly pushed Tokyo prices higher, but domestic buyers have also played a role. During the pandemic, Japanese households saved more as travel and social spending declined. As inflation subsequently increased, many people used their savings for down payments, leading to an increase in home purchases.

“We thought prices would fall during the pandemic, but the opposite happened,” Kubo said. Shapiro said low mortgage rates, long a feature of Japan's economy, have recently begun to affect the housing market in a big way.

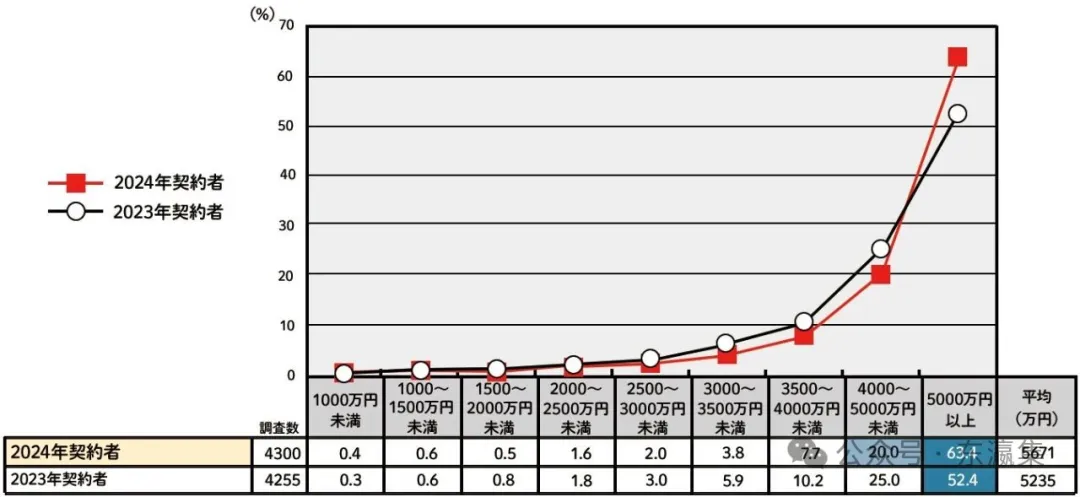

By 2024, 63.4% of new condo buyers in Greater Tokyo were purchasing homes priced above 50 million yen.

Shapiro said Japanese buyers, with more savings on hand, joined the crowd, putting upward pressure on prices. With global demand and tourism targets, experts believe the boom will continue.

“The market has changed dramatically,” Inazawa said. "The weak yen, revived inbound demand, and global uncertainty have made Japanese real estate a safe haven. Foreign capital is flowing i,n and prices are climbing. This trend is not slowing down – it is likely to strengthen."

![12 Recommended Popular Dating Apps in Japan [2024]](https://www.japanrar.com/wp-content/uploads/2024/03/1709266686-2346347888.jpg)